Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Oct-25-2011 10:37

TweetFollow @OregonNews

TweetFollow @OregonNews

The Free Market Fallacy

By Daniel Johnson, Deputy Executive Editor, Salem-News.comFor you supporters of less government and more free-market, you're barking up the wrong tree.

|

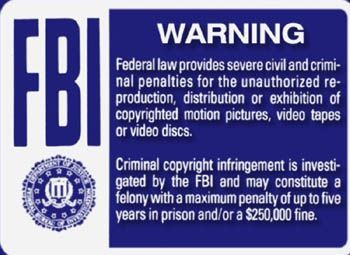

(CALGARY, Alberta) - We’ve been seeing the warnings at the start of VHS/DVD movies for so long, that we don’t even notice them anymore, except to be irritated that we have to endure them because we can’t fast forward past them. But there’s one place you won’t see that notice or its equivalent—at the start of any porn movie. Why is that? It’s at the heart of our so-called free-market system.

The British actor Sir Michael Caine has threatened to leave Britain if his taxes go up even one percent. Commenting on Caine’s threat, journalist Iain Martin writes that a rags to riches story like Caine’s (his mother was a charlady and his father a porter in London’s fish market) is what the government should be encouraging. Instead of raising taxes, he says, we need to clear “the rubble of the interfering state out of the way.” Critics like Martin miss the fact that without “the rubble of the interfering state”, the rich would have nothing.

Most people miss (or wilfully ignore) the fact that it’s only possible to own things—money, land, etc.—if there is a state to create laws and enforce those laws.

Without government there would be chaos and anarchy—what seventeenth century philosopher Thomas Hobbes described as “a war of all against all”. In such a situation, there would be no way to enforce ownership. Or as the English jurist Jeremy Bentham put it: “Take away the laws, all property ceases.”

In reality, there is no natural thing called the market, which arises from a complex set of laws that regulate commerce within a jurisdiction. It can take any number of forms depending on the decisions made by politicians and government officials who design, approve and implement those laws.

The details of the laws that create a market play a key role in determining the income and distribution of wealth in a society—going far beyond the simplistic notions of supply and demand. This is why there are billionaires. The tax system has been designed specifically by the wealthy (through their bought and paid for politicians) to make sure they get the lion’s share of the economic wealth.

Ferdinand Lundberg in The Rich and the Super-Rich (1968) gave a perfect example, from simpler days, and I quote his version in full:

“A completely different sort of tax privilege, far less widely known and not even suspected by most persons, is gained by having Congress pass a special bill giving one special tax exemptions. Many such special bills are enacted, all reading as though they applied in general.

“One such among many described by both Eisenstern and Stern concerned Louis B. Mayer, the movie mogul. The experts in the Treasury Department were mystified upon first reading Section 1240 of the Internal Revenue Code of 1954, written in the customary opaque tax language. They had not the remotest idea of what it meant. What it said was:

“Amounts received from the assignment or release by an employee, after more than 20 years employment, of all his rights to receive, after termination of his employment and for a period of not less than 5 years (or for a period ending with his death), a percentage of future profits or receipts of his employer shall be considered an amount received from the sale or exchange of a capital asset held for more than 6 months if (1) such rights were included in the terms of the employment of such employee for not less than 12 years, (2) such rights were included in the terms of the employment of such employee before the date of enactment of this title, and (3) the total of the amounts received for such assignment of release is received in one taxable year and after the termination of such employment.

“Stern supplies a translation into English of this paragraph in its generality. But what it meant specifically was the following: Louis B. Mayer, and only Louis B. Mayer, may receive all future profits in the company to which he will be entitled after retirement in one lump sum and this lump sum will be taxed at 25 percent as a capital gain even if it is not in any sense a capital gain.

“Had Mr. Mayer received these profits after retirement as they were generated he would have had to pay maximum taxes on them each year. The special bill for his benefit—Section 1240—gave him $2 million of pin money.

“How did it come to be enacted? His attorney was Ellsworth C. Alvord, who appeared before the Senate Finance Committee not as Mr. Mayer’s lawyer but as a spokesman for the United States Chamber of Commerce. And the section was so drawn so to be of no use to anyone else."

(Those were simpler times. A Wall Street banker, today, wouldn't get out of bed in the morning for only $2 million.)

The tax system is a divide and rule system. Everyone wants deductions and expect others to get soaked. American home owners, for example, can deduct mortgage interest and the wealthy only pay 15% on capital gains (plus they can also deduct mortgage interest). But, in their myopia, homeowners think they are getting some sort of advantage over non-homeowners.

I like Lundberg’s description of the tax system. It is, he writes,

“a pullulating excrescence negating common sense, a parody of the gruesomely ludicrous, a surrealist zigzag pagoda of pestilent greed, a perverse thing that makes the pre-revolutionary French system seem entirely rational.”

Let’s understand why billionaires don’t deserve their fortunes. I’ll use Bill Gates as an egregious example.

Bill Gates, computer genius that he is, would not be a billionaire today without the synergy of his initial partnership with Paul Allen, then the cooperation from his initial band of about a dozen employees, the insights of Steve Balmer, and finally the Herculean efforts of Microsoft’s tens of thousands of employees. Just as crucial is the fact that his parents were wealthy, giving him financial advantages.

Most of his fortune, and Microsoft’s growth, is the result of his placing the DOS operating system on IBM personal computers. This would not have happened without a high level connection—Gates’ mother was on the national board of the United Way with IBM chairman John Opel. She pitched Bill and Microsoft to Opel. After an initial all day meeting where Gates pitched DOS to IBM, Don Estridge, the man in charge of the IBM PC, went before the Management Committee and acknowledged that he was taking a risk contracting out the software to a small company in Seattle. Opel said, “That wouldn’t be Mary Gates’s boy, Bill, would it?” Bill was in.

Gates expertise was in computer languages and he didn’t feel comfortable doing an operating system, so he bought a program called QDOS from a Seattle programmer named Tim Paterson for $75,000.

Any person who declares himself to be “self-made” and did it all “on his own” is, in their self-delusionary way perpetuating a destructive individualist fantasy. The inheritance we receive from the past is so vast as to be beyond calculation, encompassing every bit of scientific and technological knowledge going back to the beginning of human language and the invention of the wheel.

Another Harvard dropout is Mark Zuckerberg who founded Facebook in his dorm in 2004, dropped out of school, and went to Palo Alto and is now estimated to have a net worth of $1.5 billion. But without an initial $500,000 investment from PayPal cofounder Peter Thiel or other Venture firms like Accel Partners and Greylock Partners, Facebook would have been stillborn. Zuckerberg is another “self-made” myth.

By 1955—the year Bill Gates was born—the computer revolution was well under way, drawing the efforts of some fifteen thousand enthusiasts intent on devising ways to develop and widen the use of the powerful mainframes developed in the 1940s.

The personal computer would have been developed with or without Bill Gates. He didn’t really invent anything and fortuitously landed a big deal with IBM. The man who was more qualified to develop an operating system was Gary Kildall, an erstwhile friend of Gates. Kildall, a Ph.D. in computer science had already created an operating system called CPM which was far superior to DOS. In fact, Paterson had cribbed parts of his system from Kildall’s CPM. In a legitimate business fashion, Gates had simply elbowed Kildall out of the way. (Gates could not succeed in the same way, today. Copyright laws enforced would have made DOS illegal, because there was so much of Kildall's CPM in it. CPM would prevail in today's legal environment.)

Gates later adapted other brilliant innovations like the graphical user interface that had also been developed by others. The computer revolution would likely have gone ahead sooner and better without him. Innovations like multi-tasking, were part of Kildall’s CPM, and would have become widely used much earlier if Gates hadn’t had the monopoly with IBM. Multi-tasking, as just one example, was delayed for more than a decade as a result.

The self-made man and individual genius is a chimera. No invention is the work of one individual alone, but is the culmination of untold numbers of individual inventions. It’s absurd, then, to say that any one of the interrelated units is the invention and its creator, the inventor. It was Isaac Newton who said that the reason he could see so far, was because he was standing on the shoulder's of giants.

The Wright Brothers, for example, could never have flown if the internal combustion engine hadn't been invented and developed. And the internal combustion engine couldn't have been invented and developed without the refining of gasoline. And you have to consider all the inventions and development of metallurgy which made the building of engine blocks and parts possible.

This brings us to another aspect of wealth creation—that from the community itself.

In 1870, the philosopher John Stuart Mill took part in the founding of the Land Tenure Reform Association. He argued that while private ownership of land might be necessary to achieve optimal production, increases in land values due to the general growth and development of society properly belonged to the community at large. He extended this argument to all increases in value of property that are caused by factors having nothing to do with the contribution of the individual property holder.

In a famous passage from his Principles of Political Economy, he wrote:

“Suppose there is a kind of income which constantly tends to increase, without any exertion or sacrifice on the part of the owners…it would be no violation of the principles on which private property is grounded, if the state should appropriate this increase of wealth, or part of it, as it arises.”

He went on to make the case that the failure of society to appropriate its due would result in property holders receiving undue benefits—thereby bestowing on them an “unearned appendage” to their existing wealth. This has come to pass when you have the Forbes 400 individuals/families that have somehow accumulated more than $1.3 trillion dollars of wealth.

A good example is the automobile industry. If the federal government hadn't invested $24 billion in the interstate highway system beginning in the mid-1950s, the auto industry (and the oil industry) today would be only a fraction of its current size. And the thousands of supporting businesses and millions of created jobs would also be correspondingly smaller.

Mill was not the only one who thought along these lines. Thomas Paine noted that if an individual is separated from society and given a whole continent to possess “he cannot acquire personal property. He cannot be rich.” In this way, wrote Paine,

“…all accumulation…of personal property beyond what a man’s own hands produce, is derived to him by living in society; and he owes on every principle of justice, of gratitude, and of civilization, a part of that accumulation back again to society from the whence the whole came.”

A century ago the British philosopher Leonard T. Hobhouse said in the same vein that while great fortunes were amassed through the industrial revolution, he challenged the big business owner to answer “what single step he could have taken” if it hadn’t been for the “sum of intelligence which civilization has placed at his disposal” and the “inventions which he uses as a matter of course and which have been built up by the collective efforts of generations.”

I now return to the case of Sir Michael Caine. His good fortune has come about because of government intervention in the marketplace—notably the elaborate set of copyright laws. Without them, Caine’s movies (and everyone else’s, for that matter) could be copied and distributed all over the world with no money at all flowing back to Caine for his acting abilities. Under such a system no production company would pay Caine large fees for his acting.

But wait! Such a system already exists in the porn industry which, by its very nature, operates outside the legal boundaries of enforcement. That’s why there is such an abundance of free porn available to everyone on the internet. A porn producer who tried to sue for copyright infringement would find himself going nowhere. This wide open system is what an actual “free market” in the movies looks like. Michael Caine, Steven Spielberg, Michael Douglas, et al, have their hundreds of millions of dollars only because of the “the rubble of the interfering state”.

Born and raised in Calgary, Alberta, Daniel Johnson as a teenager aspired to be a writer. Always a voracious reader, he reads more books in a month than many people read in a lifetime. He also reads 100+ online articles per week. He knew early that in order to be a writer, you have to be a reader.

Born and raised in Calgary, Alberta, Daniel Johnson as a teenager aspired to be a writer. Always a voracious reader, he reads more books in a month than many people read in a lifetime. He also reads 100+ online articles per week. He knew early that in order to be a writer, you have to be a reader.

He has always been concerned about fairness in the world and the plight of the underprivileged/underdog.

As a professional writer he sold his first paid article in 1974 and, while employed at other jobs, started selling a few pieces in assorted places.

Over the next 15 years, Daniel eked out a living as a writer doing, among other things, national writing and both radio and TV broadcasting for the CBC, Maclean’s (the national newsmagazine) and a wide variety of smaller publications. Interweaved throughout this period was soul-killing corporate and public relations writing.

It was through the 1960s and 1970s that he got his university experience. In his first year at the University of Calgary, he majored in psychology/mathematics; in his second year he switched to physics/mathematics. He then learned of an independent study program at the University of Lethbridge where he attended the next two years, studying philosophy and economics. In the end he attended university over nine years (four full time) but never qualified for a degree because he didn't have the right number of courses in any particular field.

In 1990 he published his first (and so far, only) book: Practical History: A guide to Will and Ariel Durant’s “The Story of Civilization” (Polymath Press, Calgary)

Newly appointed as the Deputy Executive Editor in August 2011, he has been writing exclusively for Salem-News.com since March 2009 and, as of summer 2011, has published more than 160 stories.

View articles written by Daniel Johnson

Articles for October 24, 2011 | Articles for October 25, 2011 | Articles for October 26, 2011

Salem-News.com:

Quick Links

DINING

Willamette UniversityGoudy Commons Cafe

Dine on the Queen

Willamette Queen Sternwheeler

MUST SEE SALEM

Oregon Capitol ToursCapitol History Gateway

Willamette River Ride

Willamette Queen Sternwheeler

Historic Home Tours:

Deepwood Museum

The Bush House

Gaiety Hollow Garden

AUCTIONS - APPRAISALS

Auction Masters & AppraisalsCONSTRUCTION SERVICES

Roofing and ContractingSheridan, Ore.

ONLINE SHOPPING

Special Occasion DressesAdvertise with Salem-News

Contact:AdSales@Salem-News.com

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

November 3, 2011 2:37 pm (Pacific time)

Naomi klein, filthy kike racist that only puppets and losers would support this zionist. you canadians are such losers, but anyone who would print your crap in the states in worse...scum of the earth, may you all join lucifer real soon.

Obviously, a highly educated and objective critic. Harvard or Yale?

Hank Ruark November 3, 2011 10:53 am (Pacific time)

Again Colli states it precisely in his last pgh starting with "Regarding..."

You honor S-N with strong, accurate and insightful comment, Dan. Make sure to keep 'em coming...

Natalie October 30, 2011 12:24 pm (Pacific time)

DJ: Since you start with the line “…you supporters of less government…”, I assume you don’t think of yourself as such. So, do you advocate for a larger government or think that we have what we deserve and should be proud of it?

Supporters of less government are those who want less government, no matter what. They are against government on principle. In reality, they are really just against government as currently practised. What I advocate is for effective government which human beings require in order to live together in groups. The fundamental problem with Western governments as practised today (The U.S. being the most extreme example) is that they have been highjacked by the wealthy and no longer serve the majority of the people.

Anonymous October 27, 2011 12:10 pm (Pacific time)

Daniel, back during my college years (early 60's) I used Hobbesonian observations quite frequently, and I appreciate

your use of him in this article, for it serves the purpose of acknowledging why we need responsible governance to

maintain healthy capitalism within a free market environment, which is now quickly growing on a global scale in both

Asia and the sub-continent of Africa. Most academics back in the 50's/60's were of a different character than they

are now. Many were WWI, WWII and Korean War veterans, and also had actual job experience other than doing academic

research, working as graduate assistant, and of course teaching which is the typical arc for many educators now, but

most have no real world job experience. We can see what has happened to many of the students (including High School

kids) who have currently finished their degrees in areas such as the Humanities/Social Sciences...they have no

marketable skills, and their teachers also have no marketable skills outside of their own narcissistic self-images. Daniel as you know the majority of businesses in America are small to medium sized (open a phone book to the yellow pages), and they employ approx. 2/3's of all workers. Some have incorporated, some have not. They are very sensitive to taxes, federal and state, as well as the growing regulations and fees that impact their bottom line.The majority

of Americans this morning, like most all mornings, got up and went to work. Most of the unemployed keep looking for

employment, as do the underemployed. Our political system is a dynamic system, which means that it adapts to the

changing environment. Sometimes it can do that quickly, and when we have poor leadership, it takes longer. Our three

different branches of government have been a Godsend for American democracy. The infighting going on in both the Senate and the House is doing exactly what the Founders wanted to happen. It delays legislation so things can be evaluated more thoughtfully. When Obama first took over he had a full majority and passed legislation that not one conservative voted for, and now most democrats are running away from that legislation because they know it has

prolonged these economic doldrums. Bottom line Daniel, the OWS movement may morph a bit in the fullness of time, but

America will not become like europe (they are failing because of their huge government spending, as are several of our states), and as new leadership takes over after our next national election, you will see how quickly we pull out of this recession and become what we have always been, the most exceptional prosperous nation that ever existed. Unfortunately there is much violence on the horizon, and it is those on the sidelines that are egging on people to expose themselves to injury while they remain safely on the sidelines. They may not like what the future holds for them though. They are not unknown. Note:"It turns out the finance sector only makes up 14% of the top 1% of American earners..." // http://finance.yahoo.com/blogs/daily-ticker/believe-not-wall-street-doesn-t-dominate-top-183915328.html

See Naomi Klein. She refutes your entire post.

http://www.naomiklein.org/articles/2011/10/occupy-wall-street-most-important-thing-world-now

M. Dennis Paul, Ph.D. October 26, 2011 11:56 pm (Pacific time)

Brilliant article! Apparently there exists a group of "anonymous" individuals who collectively failed to comprehend your intent. Nothing new... they spend quite a bit of time trolling here attempting to demonstrate a "superior" knowledge on many subjects.. of which have little or no bearing on the articles to which they comment.

For several decades, corporations have produced hiring documents which demand ownership of any innovations or inventions created during the individual's employment.. and often for some period post employment. It is a form of insurance protecting them (the corporations) from competition. These corporations, it is found, are often some of the loudest proponents of the "Free Market". Thanks for this article. I look forward to more.

Thanks for your comment!

Anonymous October 26, 2011 6:13 pm (Pacific time)

Daniel the OWS is quite disjointed on a national level, and I extrapolate on a global level also. I have been to three different ones in my area several times since they began, and each group is a mixture of other groups, each desiring different agendas. There is some organizing going on, on the national level, but these are really small representative samples of our highly diverse population. Nothing will really get done at the earliest until around spring of 2013. Most likely that will be a change in tax law which will be of a long term nature is my guess. That's how our political system works, and other than martial law, it will be slow change coming. In fact, violence is also picking up, as are the number of arrests. People are getting tired of the bad behavior that is increasing. In today's news the OWS group in Portland Oregon legally "incorporated" and already there is infighting and accusations about misappropriation of funds in the amout of $20 grand. Just on the news an hour ago. The below linked Gallup poll (see "implications" analysis) is in my opinion reflective of the voter's mood of far left policies (2010 election, and recent regional ones verify) in terms of having diminishing economic policy development trust of Whitehouse and other liberal pursuits. The Gallup-referenced population (it represents the entire American population!) completely dwarfs those in the OWS movement, which daily gets smaller and smaller. (Wait till the bad weather sets in). Please notice the range change in both time and political party membership categories in this poll. It's very revealing for those interested in political science and macro sociological insights: http://www.gallup.com/poll/150341/Record-Low-Favor-Handgun-Ban.aspx?version=print

You can't say, “that's how our political system works”, because the reality is it doesn't work for the vast majority of people. That's the driving force behind the Occupy movement. The political system in that sense is irrelevant. That’s also why the movement, at this point, seems so disjointed—there is a vast array of complaints that people have and the movement is not going to gel until enough people realize that it’s the system itself that is wrong!

There is a revolution coming and I have two quotes referencing that point.

Nobel economist Joseph Stiglitz wrote in last May's Vanity Fair:

"Americans have been watching protests against oppressive regimes that concentrate massive wealth in the hands of an elite few. Yet in our own democracy, 1 percent of the people take nearly a quarter of the nation’s income—an inequality even the wealthy will come to regret"

In the late 1960s, when the current inequality began to grow, Harvard economist John Kenneth Galbraith wrote:

"People of privilege will always risk their complete destruction rather than surrender any material part of their advantage. Intellectual myopia, often called stupidity, is no doubt a reason. But the privileged also feel that their privileges, however egregious they may seem to others, are a solemn, basic, God-given right. The sensitivity of the poor to injustice is a trivial thing compared with that of the rich. So it was in the Ancien Régime. When reform from the top became impossible, revolution from the bottom became inevitable". (italics added) He was referring to the French aristocracy who did not see the French Revolution coming until it was too late.

I don't understand what your point is, unless it's being an apologist for the wealthy.

Anonymous October 26, 2011 1:54 pm (Pacific time)

Daniel the below link just now worked, give it another try. I also excerpted a brief oberview of our tax table that you might find interesting. In terms of poverty, just like mortality rates, different countries have different measurement methodologies, so it's a apples/orange scenario at best. I have seen our census reports on poverty here in America, and half of those who are considered in poverty are homeowners. Poverty here would be considered something entirely different in most European countries, and even vastly different in 3rd world countries. Of course here in America, as well as Canada, our poor citizens can rise out of what we label poverty, while in the rest of the world, that's a pretty rare occurrence. In regards to the capital tax and revenue information, it also applies to regular income tax. It is the capital gain profit/investments that is the wealth and job creator. Many reasons why our economy went into a recession, but the policies used currently do not work. A few years ago Canada was in a mild recession and your leaders green-lighted more drilling, plus your corporate tax rates are about 1/2 half of ours. Our illegal problem has also worsened our economic situation. The taxes paid by the illegals are a small fraction of their social costs. "Income taxes. Federal income taxes are progressive, which means your income is taxed at higher rates as you make more money. Let's take a married couple filing jointly as an example. In 2011, after deductions and exemptions:

• the income between $0 and $17,000 is taxed at 10 percent;

• the income between $17,000 and $69,000 is taxed at 15 percent;

• the income between $69,000 and $139,350 is taxed at 25 percent;

• the income between $139,350 and $212,300 is taxed at 28 percent;

• the income between $212,300 and $379,150 is taxed at 33 percent;

• the income above $379,150 is taxed at 35 percent.

Keep in mind that even if you're in the top bracket of 35 percent, you don't pay that tax rate on all your income. You pay 10 percent on the first $17,000, 15 percent on the money between $17,000 and $69,000, and so on... Buffett slightly glosses over the fact that if you're in the 25 percent tax bracket, your overall tax rate is less than 25 percent. And, the more money you make, the more income taxes you pay, while payroll taxes seem less and less significant as a percentage of income. We're dubious someone would pay as high as a 41 percent tax rate, as Buffett claims someone in his office now pays. (The top income tax rate is 35 percent, but payroll taxes as a share of income decline as income rises, which makes it difficult to get above 37.9 percent, according to the people we ran this by at the Tax Policy Center.) We contacted Buffett's offices as Berkshire Hathaway about this point but didn't hear back." http://www.politifact.com/truth-o-meter/statements/2011/aug/18/warren-buffett/warren-buffett-says-super-rich-pay-lower-taxes-oth/

I think you're trolling to try to move away from the real issue and that is that the political/economic system is irretrievably broken. That's what the Occupy movements are about and why they seem so disjointed. There are so many issues to focus on that few are noticing that the whole edifice needs to be torn down and started fresh (not all that practical but it's the reality). The only real alternative, as I've argued in other columns, is that America needs a Second Revolution. That's what the Occupy protesters may end up facilitating.

Anonymous October 26, 2011 10:18 am (Pacific time)

Daniel, please note the below is by a government study as per the U.S. House of Representatives:

"The result that tax revenue tends to increase following a reduction in the tax rate may seem counterintuitive..." "When capital gains tax rates are high, investors avoid paying the tax by holding onto assets they would have otherwise chosen to sell. This creates a "lock-in effect," which lowers capital gains realizations by shrinking the tax base..." What's going on now is "fear of the unknown" when it comes to future tax policy, thus people are holding on to cash until there is some long term tax laws in place, and hopefully a reduction in federal spending. Hard to do long term financial planning in today's world.

"Tax Revenue. The historical evidence suggest that capital gains tax reductions tend to increase tax revenue. When capital gains tax rates were lowered in 1978 and again in 1981, revenue climbed steadily. Conversely, when the tax rate was increased in 1987, revenue began declining despite forecasters predictions it would increase. For instance, capital gains tax revenue in 1985 equaled $36.4 billion after adjusting for inflation, yet $36.2 billion was collected in 1994 under a higher tax rate. In other words, tax revenue in 1994 was slightly less than it was in 1985 even though the economy was larger, the tax rate was higher, and the stock market was stronger in 1994. Macroeconomic Effects: Except for a brief recession in 1990-91, the U.S. economy [had] enjoyed a 15-year expansion. However, the growth rates of the economic upswing that began in 1991 have been relatively low compared to other post-war expansions. As a result, American incomes and living standards have been growing more slowly.

These low growth rates can be partly attributed to counterproductive tax policies that undermine long-term growth by discouraging saving and investment. Although broad tax reform is needed to address the deficiencies in the tax code, many economists believe that reducing the capital gains tax rate is an important step in the right direction. A capital gains tax reduction would enhance incentives to save and invest by increasing the after-tax return from investment. The effects of a capital gains tax reduction should not be overstated; nonetheless, its beneficial effects on the economy would make a significant contribution to long-term growth. Historical Evidence:

Historical evidence undermine the claim that capital gains tax reductions lower revenue. Figure 3 shows that, historically, taxes paid on capital gains have tended to increase after a reduction in the capital gains tax rate. When capital gains tax rates were lowered in 1978 and again in 1981, revenue climbed steadily despite government forecasters' claims that it would fall. Conversely, when the tax rate increase was enacted in 1987, revenue began declining, although forecasters predicted it would increase." http://www.house.gov/jec/fiscal/tx-grwth/capgain/capgain.htm

You're talking about capital gains taxes, which I don't refer to, at all. But, when you look at the comparatively miniscule amounts collected, it's obvious that the wealthy have the American people by the short hairs (and not just in America). Other nations have reduced cap gains taxes from highs of around 90%, which worked in terms of fostering national economic fairness and equality of a sort. Now there is a conspiracy of the rich to make sure that every government is competing in a race to the bottom. America has 21% of its children living in poverty compared to just over 3% in the Scandinavian countries. What does that tell you about the role of the rich in your society?

Anonymous October 26, 2011 10:17 am (Pacific time)

Daniel, regarding Warren Buffett, here is an excellent source about his assertions. You will also find an overview of our tax table that you may find

beneficial in your quest for a better understanding of some U.S. Tax policy. Please keep in mind that there are tens of thousands of pages in our federal tax laws. Then each state, and other taxing authorities, have their laws also. Thus a flat tax, or some simplified tax policy is hopefully going to be a campaign issue with teeth next year. http://www.politifact.com/truth-o-meter/statements/2011/aug/18/warren-buffett/warren-buffett-says-super-rich-pay-lower-taxes-oth/

Your link doesn't work.

Anonymous October 25, 2011 6:28 pm (Pacific time)

Actually Warren Buffet does not pay any income taxes because he has set his revenue stream to come from "capital gains," (currently 15%) which is from investment capital that had already been taxed via federal, state, and any other taxes and fees that come with the particular area he lives in. For example in New York City and surrounding areas, it's very common to see people who make over $200,000 a year to pay over 50% of that amount in taxes. When we had a high margin tax rate at around nearly 90%, very few of the super rich paid that because of the various "loopholes." If you do a little research just going back to the early 1980's, when the margin tax rate was reduced to 34%, tax revenues were significantly greater than when the tax rates were over twice that rate. Also over 20 million private jobs were created during this reduced tax period. As far as Buffet, he could always write a personal check if he wants to pay more tax, but it was a PR stunt regarding his capital gains rate and the income tax rate of others. It's been proven ad nauseum that reduced tax rates bring in more tax revenue and create more jobs. What we have is a spending problem. 40% of every federal dollar spent is borrowed. In Louisiana, they reduced taxes several years ago under Gov. Jindel, and reduced government spending, and more tax revenue has come in and thousands of "private sector" jobs have been created yearly. Same thing is happening in some other states that have pursued the same process. The evidence is clear on what needs to be done, but like that mentally ill patient, they will never look at the facts available to them, maybe they are just unable to grasp the historical record?

Because you don't post wit a name, unless you can give credible references for your claims, I can only conclude that you're trolling. Sounds like Laffer Curve kind of stuff, to me.

Roger E. Bütow October 25, 2011 4:08 pm (Pacific time)

DJ: Personally, I swear that I've never watched porno, but I have a "friend" (hint hint) who has tons and I "forced" him to let me watch several----But ONLY as far as the the trailers (ha ha). ALL of them had that same FBI WARNING, DJ....But I do believe that you've done the industry a favor. Maybe more S-N.com readers will ask THEIR "Friends" if what I'm saying is true or naught---As in "You've been a naughty naughty, boy, you need to be punished!" :+) :+) :+) OK, I just thought I'd interject some clever levity into a serious subject...But hey, DJ, you probably understand the importance of getting your audience's attention. Sign me S-N.com's Class Clown

Anonymous October 25, 2011 1:17 pm (Pacific time)

its not policies that fail, but those in charge of the policies.. which daniel will refuse to address.

Of course I address them,Stephen, what do you think the Mayer example about?

Anonymous October 25, 2011 9:30 am (Pacific time)

What the 'Taxing the Rich' Rhetoric Really Means...

When I was in college, I took a course in clinical psychology. One day, the professor shared an experience he had with a paranoid schizophrenic patient. In one of his first months working at a mental hospital (as they were then called), he met with the patient in his office. The patient said, "Well, I don't feel comfortable talking to you because there is a hidden microphone in this office." "Where is it?" my professor asked. The patient responded: "It's hidden in the doorknob." The professor then took apart the door knob, laid all the parts out on his desk, and said to the paranoid patient, "See, there's no microphone hidden here." The patient looked at the parts, looked up at the ceiling, and insisted, "It's up in the light bulb!"

The point of this story is that there's nothing you can do to allay the paranoid thoughts of a paranoid schizophrenic. Those analysts who address the "tax the rich" and "the rich must pay their fair share" rhetoric are facing the same issue: those who use this rhetoric will never acknowledge the tax rates paid by the rich, accept the facts, and respond with the words, "oh, I didn't realize that the top 15 percent pay seventy percent of the income taxes. Never mind!"

They will persist with their rhetoric forever. The reason is that the rhetoric is driven not by the numbers of who pays how much in taxes, but by a desire to build a public relations foundation, an image. Those who don't respond to real facts don't care what the real facts are. The "tax the rich" slogan was not begun after a careful analysis of IRS data in the first place.

I've read your post three times and I still don't know what your point is. Unlews you're arguing that the rich already pay enough or even too much in taxes. But if you want to go with facts--Warren Buffest has argued more than once that the rich should be paying more. He says his tax rate is less than most of the employees in his office, including his secretary.

The point of a progressive tax system is that the more you make, the more you pay--up to a specified maximum,--which used to be around 90% and is now I believe about 25%.

COLLI October 25, 2011 5:48 am (Pacific time)

Dan: One fact that you (intentionally or otherwise) highlight is that some individuals spend considerable time searching for opportunities. These opportunities are frequently based upon new discoveries, newly developed methods, newly developed systems, and newly developed equipment. Some of these opportunistic individuals became super rich as a direct result of finding such opportunities and capitalizing on them. In some cases, minimal personal financial risk was involved but in others, the risk was considerable. A certain amount of “right place / right time” luck played a part in a few such successes. Regardless of the sequence of events involved, individuals have a right to profit from their willingness to take risks, the personal time expended, and their natural or developed personal mental abilities. To these individuals I say “Good for you”. Regarding the less than honest attorneys, marketing gurus, and sub-human political vermin who help such individuals avoid fair and reasonable taxation and existing laws, they should be targeted by our law making body. However you, of course, see the problem inherent in this picture . . . the law making body I refer to is largely populated by the sub-human political vermin also referenced. i.e. the fox is not only watching the hen house . . . he has taken-up residence there! Good article Dan. It brings little known facts to light in a way that should offend no one except those who need to be offended. Keep them coming, please.

[Return to Top]©2025 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.