Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Nov-08-2009 17:36

TweetFollow @OregonNews

TweetFollow @OregonNews

Policy Analysis: HR 3962 Division A - Affordable Health Care

Ersun Warnke Salem-News.com Business/Economy ReporterThe major change policy wise is in increasing taxes on upper income individuals and using this money to fund health care credits for low wage earners.

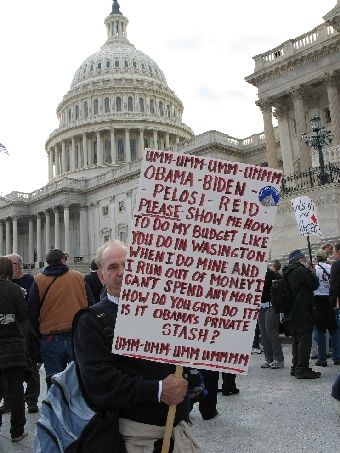

Protest Thursday against Healthcare in Washington D.C. photo by Ken Potter, for Salem-News.com. |

(EUGENE, Ore.) - Establishes minimum requirements and eliminates anti-trust exemptions for private insurers. Establishes Health Choices Administration, and Health Insurance Exchange. Establishes public health care option bound by same requirements as private insurers.

Mandates employer and individual health care coverage. Imposes taxes to enforce mandates. Imposes taxes on individuals with incomes over $500,000 or $1,000,000 filing jointly.

At 1990 pages HR 3962 is a dauntingly long and complex piece of legislation. It is safe to say that virtually zero private citizens will read it. Pundits, news anchors, and journalists with an interest in factual reporting may get their staff or interns to read it, but that is probably about as good as it gets. In the gap, most of the other reporting on this issue will be quotes from self interested parties, either repeating complete falsehoods, or selectively cherry picking the facts that suit their own agendas.

This article is a review of the Division A of HR 3962, which is legislation to implement major changes in how health care is delivered for the entire population. I have dutifully read the first 360 pages of the bill in order to provide this analysis.

Division B of HR 3962 is the largest section of the bill, and it deals entirely with making administrative changes to existing government health care programs (Medicare and Medicaid). Division C covers plans to increase investments in health care infrastructure and health care training. Division D cover plans for “indian” health care.

The first question that some people may have is: why is HR 3962 so big?

To answer that question: Division A devotes 140 pages to a verbatim reprinting of the Protocols of the Elders of Zion, and the rest lays out the extremely complex bureaucratic process for administering death panels, forced vaccinations, and nationwide “health and wellness internment camps.”

I kid.

The fact of the matter is that developing rules for any program that is going to serve 300 million people is bound to be extremely complex.

When those rules must take into account a mixed marketplace of private for-profit and not-for-profit providers and insurers, federal insurance and health programs, the differing laws and programs of 50 sovereign States, and the ad hoc legislation that has been created over the past 50 years to administer this mess, the results are necessarily long and complex. This is an inevitable outcome of large bureaucracy.

The same process and methodology is used inside any massive private health insurance company, except that unlike with the government, there it is performed in secret by individuals with no electoral accountability.

My review of the bill will simply proceed in chronological order according to section. I will focus on the sections that I consider to be most important. Those that I have skipped are largely supporting text for the policies in the sections that I am highlighting.

I would mention that this is a somewhat superficial review because it is based on a plain text reading of the resolution as opposed to a thorough analysis that takes into account the full body of related Federal law.

*Title I – Immediate Reforms*

101. Creates temporary insurance coverage for people who have been denied coverage due to pre-existing conditions. Sets premiums at maximum of 125% of market level. Establishes $1,500 deductible with maximum of $5,000 per individual and $10,000 per family total cost sharing per year. This coverage will be terminated when Health Insurance Exchange, which includes insurers who are not allowed to exclude people with pre-existing conditions, is established.

102. Requires private insurers to give rebate on premiums if medical expenses are less than 85% of expected amount. Effectively sets limit on profits. Expires when Health Insurance Exchange is established.

103. Bans insurers from rescinding coverage without clear and convincing evidence of fraud or abuse, and establishes requirements for third party review.

104. Requires Secretary of HHS (Health and Human Services) to perform annual review of premium increases. Establishes that premium increases must be justified.

105. Requires insurers to cover dependents up to the age of 27.

109. Bans lifetime limits on coverage.

110. Bans reductions in coverage for retirees under employer health plans unless same reductions apply to active employees.

111. Establishes reinsurance trust fund of $10 billion to pay employer health plans 80% of costs over $15,000 and under $90,000 for covered employees. This is basically a subsidy for companies like GM, Ford, and other big industrial employers who now face ruinous health care liabilities. The alternatives are that the companies default and the government pays through Medicare, so this is a neutral measure from the government's perspective, which will allow these companies to avoid bankruptcy or emerge from bankruptcy more easily.

113. COBRA benefits, which allow employees to continue buying health insurance under their old plan after they are terminated, are extended until Health Insurance Exchange is established.

115. Requires creation of an electronic system to administer claims. System is required to allow for real time determination of costs of coverage at the point-of-sale (doctor's office, hospital, etc). The effect would be a system where health care beneficiaries walk in, provide their information, probably with an electronic swipe card, and immediately know exactly what the cost of care will be and what will be covered. Claims must be settled on the spot. Legislation allows 2 years for the creation of rules for this system, and 6 months to 5 years to establish rules for implementation and enforcement. In other words, this will lead to major savings in time and energy spent on paperwork, but will probably take at 5-10 years to have an effect.

*Title II – Guaranteed Standards for New Plans*

211. Bans exclusions for pre-existing conditions.

213. Establishes that premiums may not vary except on the basis of age, with no more than a 2:1 ratio, on the basis of geographical location, and on the basis of family size.

222. Establishes essential benefits. Sets maximum cost sharing of $5,000 per individual and $10,000 per family. Requires that cost sharing be arranged so that policy covers at least 70% of care. States that insurers are not required to cover abortions (Every single insurer will cover abortions, seeing as how they cost a tiny fraction of providing full maternity care). Establishes that public health care plan will not be bound by any restrictions on using public funds to provide abortions. Requires report in one year on the cost and need of including oral care coverage in health plans.

223. Establishes Health Benefits Advisory Committee chaired by Surgeon General. Committee is to have nine Presidentially appointed non-Federal employees, 9 non-Federal employees appointed by the Comptroller General, and up to 8 Federal employees appointed by the President.

231. Requires establishment of uniform marketing standards.

232. Requires establishment of rules for grievance and appeals process related to claims, with external review, and expedited process for urgent claims that have been rejected.

233. Requires policy terms to be disclosed in clear and understandable language, along with inclusion of information on policy holder's rights, and transparent disclosure of cost sharing provisions.

240. Requires that information of end of life planning and advanced care directives be provided. Specifically prohibits any information discussing euthanasia, even where legal, such as Oregon.

241. Establishes Health Choices Administration with a Commissioner to be appointed by President and confirmed by Senate. This will be the main organization overseeing the Health Insurance Exchange.

262. Eliminates exemption from anti-trust laws for private health insurance providers. These laws prohibit price fixing, collusion in market allocation, and monopolization.

*Title III – Health Insurance Exchange*

301. Establishes Health Insurance Exchange where individuals can purchase coverage from insurers offering qualifying plans. Allows businesses with 25 or fewer employers to purchase coverage on exchange in first year, and businesses with 50 employers or less to purchase coverage in second year, and opens up exchange to all employers in third year.

307. Establishes health insurance trust fund to provide affordability credits funded by taxes in Title V.

310. Provides $5 billion in funding for issuing of grants and loans to non-profit member run health care cooperatives, which must meet same standards as private insurers offering plans on Health Insurance Exchange.

321. Establishes public health insurance plan, which must operate according to same rules as private insurers.

322. Provides $2 billion in initial funding for public health insurance plan. Requires that plan premiums fully finance costs.

341. Establishes affordability credit for U.S. Citizens and lawful immigrants.

343. Establishes that affordability credit will limit premium and out of pocket expenses in proportion to income for individuals under 400% of Federal Poverty Level. For individuals at 133% of the Federal Poverty Level, premiums are limited to 1.5% of adjusted gross income and out of pocket expenses are limited to $500. These numbers scale up to 12% of adjusted gross income and $5,000 in out of pocket expenses for individuals at 400% of the Federal Poverty Level. Currently the Federal Poverty Level is $10,830 for an individual in the 48 continental States.

*Title IV – Shared Responsibility*

401. Requires individuals to obtain health care coverage.

410. Establishes employer responsibility to contribute 72.5% for individual coverage and 65% for family coverage. Prohibits offsetting salary reductions. Gives option of paying 8% of salary as opposed to providing coverage. Provides exception for small employers, limiting contributions for employers with less that $500,000 in total payroll to 0, for $500-$585,000 to 2%, $585-$670,000 to 4%, and $670-$750,000 to 6%.

415. Requires impact study to determine if mandate is creating undue hardship on businesses.

*Title V – Amendments to Internal Revenue Code*

501. Establishes tax on individual incomes of 2.5% of adjusted gross income not to exceed cost of coverage for individuals who do not obtain coverage.

511. Imposes excise tax on employers electing to offer health care coverage, but failing to provide it. Tax is $100 per day per employee. For employers not electing to offer health care coverage, the 8% tax on salary applies, with the exceptions listed above.

521. Provides small business credits for offering health care. Credit is 50% of expenses for employees with a salary of $20,000 or less, and decreases progressively up to a salary of $40,000. Provides tax credit to small businesses with less than 25 employees on a similar basis, but limits it to employees earning less than $80,000. 551. Imposes 5.4% tax on individuals with adjusted gross incomes over $500,000 or joint filings over $1,000,000.

552. Imposes 2.5% tax on medical devices.

*Conclusion*

These provisions are the essence of HR 3962 as it applies to major changes in how health insurance is bought, sold, and regulated. At this point, the House and the Senate will begin to negotiate on a consolidated bill. Many of these provisions are likely to change in large or small ways. The purpose of this analysis is to provide a clear picture of what the House has actually proposed, which should give you some insight into the further negotiations, and the merits of the final bill.

My own conclusions are that this is an imperfect bill, but that it represents the Federal government doing the best that it can under the circumstances. The new regulations on private insurers seem to be basic common sense and in no way punitive. The public option is set up to run on an equal basis with private insurers, and required to fund itself through premiums.

The major change policy wise is in increasing taxes on upper income individuals and using this money to fund health care credits for low wage earners. This seems reasonable under the circumstances. The greatest flaws with this bill have to do with the fact that it is extremely difficult to administer anything on the scale of the entire United States.

It would be greatly preferable if individual States would fulfill their responsibilities to their own citizens and provide reasonable public health care options. I am extremely optimistic about the inclusion of funding for non-profit health care cooperatives. I think that this model would be preferable to government or for-profit corporate health care, and it is heartening to see that it has been thought of and included in this bill.

I will leave you to analyze these matters for yourself, but I would strongly encourage you to contact your elected representatives to share with them whatever informed opinion you may reach.

Salem-News.com Business/Economy Reporter Ersun Warncke is a native Oregonian. He has a degree in Economics from Portland State University and studied Law at University of Oregon. At a young age, his career spans a wide variety of fields, from fast food, to union labor, to computer programming. He has published works concerning economics, business, government, and media on blogs for several years. He currently works as an independent software designer specializing in web based applications, open source software, and peer-to-peer (P2P) applications.

Salem-News.com Business/Economy Reporter Ersun Warncke is a native Oregonian. He has a degree in Economics from Portland State University and studied Law at University of Oregon. At a young age, his career spans a wide variety of fields, from fast food, to union labor, to computer programming. He has published works concerning economics, business, government, and media on blogs for several years. He currently works as an independent software designer specializing in web based applications, open source software, and peer-to-peer (P2P) applications.

Ersun describes his writing as being "in the language of the boardroom from the perspective of the shop floor." He adds that "he has no education in journalism other than reading Hunter S. Thompson." But along with life comes the real experience that indeed creates quality writers. Right now, every detail that can help the general public get ahead in life financially, is of paramount importance.

You can write to Ersun at: warncke@comcast.net

Articles for November 7, 2009 | Articles for November 8, 2009 | Articles for November 9, 2009

Salem-News.com:

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

Engle November 18, 2009 8:20 am (Pacific time)

Mr. Ruark I agree with your following question, but what do you suggest we do with those who fail to pay? "WHY should some,for whatever reason, be able to evade what all must pay for, one way or another ?" If we have able bodied people who refuse to work, what then? Do we open up debtor's detention centers and force people to work?

Henry Ruark November 11, 2009 5:06 pm (Pacific time)

Engle:

You wrote:"...when you winnow out those that can afford coverage and choose not to, along with some other culling,..."

Carefully worded to attack, deny, distort and defeat the basic principle behind fully mandated healthcare, content analysis indicates.

WHY should some,for whatever reason, be able to evade what all must pay for, one way or another ?

Those so evading simply push off costs on others, via ER or transfer by devious means to variety of other payers.

IF one plays enough games with enough numbers and enough distorted questions, one can perhaps even have some persons manipulated into covering the evaders without fed/program OR funding.

Fact is we can no longer support unavoidable costs very clearly from broken system, with huge impact on lifestyle, health, education, other costs continuing, aggravated by what healthcare manipulation now forces in those areas, too.

Mandate for those who can pay, with demanded subsidy for those who cannot, administered via dedicated agency vs only other choice --private-profit corporate employees-- surely illuminates easy decision on more trustworthy choice -- IF we use rep.govt as OUR tool, well controlled by means already demonstrated daily in millions of ongoing societal, economic, cultural and even religious areas.

We HAVE the system-in-place, yet allow $$$-perpetrators to impose on us all manipulation of world/recognized and fully human-right to produce $$$$ and power for the few.

Ersun Warncke November 12, 2009 9:55 pm (Pacific time)

If you are interested in seeing how large pharmaceutical companies actually spend there money, take a look at Pfizer's ("the world's largest research based pharmaceutical company") annual report from 2008: http://media.pfizer.com/files/annualreport/2008/financial/financial2008.pdf --- RandD is 16.5% of revenue. Selling, Informational, and Administrative costs are 30% of revenue, and profits are 16.8% of revenue. Brilliant arrangement, at least for investors. Of course, the very fact that it is a profit driven company means that RandD will be guided by what drugs are most profitable, not which ones show the greatest potential to cure illness or treat disease. They also mention their effective tax rate: 17% ... lower than that of an impoverished minimum wage worker.

Thomas Fitch November 12, 2009 12:34 pm (Pacific time)

The following quote: "I read an article a few years ago but didn’t keep the link. I’ll try to find it. The person quoted in the article said that the vast majority of drug research was done by the public sector. Then, when a lead looked promising, the drug companies took it over. The point the researcher emphasized was that the drug companies do very little original research, at least research that costs a lot of money. Just one more area where we are all getting scammed. BTW, article on Canada in the works..." the latter is way beyond fantasy. Good look finding a source that could stand up to some peer review. I worked in the pharmacy industry for over 20 years and have never read anything so misleading as this. Maybe that is what they do in Canada, and that explains why a huge percentage of my sales went to Canada because your drug industry could not meet demand much less keep up with our dynamic technology. Many of your citizens are alive today because of our free market system that constantly develops new drugs and medical technology, whereas Canada also benefits from our creativity. Just you typing away on that keyboard is a benefit of the American free enterprise system. We are happy to provide it for you, even if you don't appreciate our largess.

.!.

Were you at such a level in the drug industry that you would know this? Or did you just do what you were told and believed what you were told to believe? In one of your other posts you say you work for Safeway, not a leader in drug research. The publicly funded research I refer to is what is done at the universities across North America, not just in the U.S. Ring a bell?

Thomas Fitch November 12, 2009 10:46 am (Pacific time)

In terms of when employee related heath insurance began, here is my two cents worth. America’s employer-based health insurance system exists largely by accident. It started as a 50 cents-a-month scheme for teachers, offered in the 1920s by a Dallas hospital looking for ways to keep its wards full. It grew as a result of bureaucratic accident and business opportunism — not legislation, let alone constitutional amendment — and for decades it offered superb care at reasonable prices. It doesn’t any more. It denies cover to many and doles out too much care to many more at prices employers and taxpayers can no longer afford. Few serious politicians in either main party deny that large parts of it are failing. I work for the Safeway Corporation and we have a fantastic health insurance program that is based on responsible behavior to help keep costs down. There have been congressman who have said our program could easily be applied to national heathcare. Unfortunately, this activity going on in DC is not about healthcare in my opinion.

Daniel Johnson November 12, 2009 9:35 am (Pacific time)

Engle, you write: "The top issue for Americans is having jobs, so that's where legislatures should prioritize." Why should the legislatures have anything to do with this? Isn't this the responsibility of the free market? If people don't like it, let them eat cake. And my comment about the drug industry is accurate. Don't you know how free enterprise works? Privatize the profits and socialise the losses.

Engle November 11, 2009 6:32 pm (Pacific time)

Daniel Johnson we could bring our military forces back from all over the world, it would change national costs very little for quite some time, except more personnel would likely get out of the military, further raising our unemployment rates. Please note we have considerable fixed DOD costs, and it would take years to reduce the size of our military to greatly offset costs, which is a pretty bad idea in today's violent world. There are of course other dynamics to consider,e.g., we get quite a bit of positive economic kick from our defensive spending on local levels. Reducing various defense contracts would also increase the unemployment rates. There are clear records of the latter scenario. We have diminishing resources, i.e. , revenue is down across the board on city, county, state and federal levels. To finance the current House bill for healthcare one of the many tax and fee increases in that monster calls for an 8% additional tax on payrolls over $500,000. I don't know if you have ever had a business or have a business accounting background, but this will only serve to quicken the demise of more businesses, driving up unemployment and further decreasing revenue. DJ your brief analysis of the pharmaceutical industry is highly inaccurate. Henry my below post was written as a simplification, it was a very brief overview and I am well aquainted with the dynamics of that period having lived in a portion of it. It was the free market that pulled us out of the depression, not any government program. That is a well known and proven fact. No one can point to any country past or present where a government spending program, in place of a free market system, created prosperity. I believe FDR had some fantastic policies, but he and congress should have had more trust in the American free market system, and that depression would have been over much quicker. The same situation applies in today's financial downturn, unless of course you have some powers who are intentionally trying to bankrupt us by hampering the primary engine of our economy: small and medium-sized businesses. The top issue for Americans is having jobs, so that's where legislatures should prioritize. Without incoming revenue it doesn't matter what healthcare legislation gets passed, we won't have the resources to provide for it. How do you like how the gov. is doing with H1N1? Post Office? Amtrack? Tennesse Valley Authority? etc.?

Henry Ruark November 11, 2009 11:11 am (Pacific time)

Engle et al: Per usual yrs re FDR-era events distorted and incomplete. With "war on" actions by FDR forced by very large overall concerns, leading to active struggle ignored in yrs, with this result only partially exposed then and now still in doubt. Gains of hcare via workers then continued to be struggle beating any gains from wartime suppliers; ask anyone living those years inside the conflicts going on generally. Failure of free-markets then prevented only by wartime full demand, necessity for any action to save world from the totalitarians, additional very large trees in exceptionally complex forest of issues...yrs oversimplifies and deludes us currently re real meanings of events-then. Check out any standard history for full details, to see true(er) picture of unique situation from which FDR can only emerge as heroic leader, not misled economic misanthrope as you seem to wish him to be remembered.

Engle November 11, 2009 10:01 am (Pacific time)

Daniel Johnson with diminishing resources how does America finance a national healthcare program? Also where did you come up with the stat of 40 to 50 million uninsured? President Obama stated 30 million during his speech to the joint congress a while back, so I would actually like to know both sources if possible? I heard when you winnow out those that can afford coverage and choose not to, along with some other culling, the number drops to around 10 to 11 million uninsured as per the Congressional Budget Office (our gold standard for government stats). A number certainly very high, but a number that could be addressed via direct subsidy that would not require a national plan. By the way is not Canada also running into some financial difficulties in regards to your heathcare program that is requiring both a cutback on services as well as an entire re-evaluation of that program? As you know Great Britain has been revamping their national program by allowing more private insurers into their health system. My hope is that your country works things out so we can use your model of problem-solving techniques. Also do you know what percentage of your RX is imported from our drug manufacturers, which your government subsidizes? Ironic that American citizens buy Canadian drugs made in America at a lower price. So if our drug manufacturers start to decline in inventing and producing new drugs along with medical diagnostic equipment, does Canada have a plan B? How's your infrastructure in that area? Do you have enough trained people in research and other area's to make up the gap if our drug firms start to fail? I guess if you did they would be online and you wouldn't need our resources. Pretty expensive bringing new drugs and equipment online. Research and Development costs, along with many failures before you get a viable product(s), and so many other costs too numerous to mention. Though I have heard that in some area's of drug manufacturing Canada leads the world in exports. Are you familiar with those drugs?

I read an article a few years ago but didn’t keep the link. I’ll try to find it. The person quoted in the article said that the vast majority of drug research was done by the public sector. Then, when a lead looked promising, the drug companies took it over. The point the researcher emphasized was that the drug companies do very little original research, at least research that costs a lot of money. Just one more area where we are all getting scammed. BTW, article on Canada in the works.

Numbers of uninsured: The number I heard consistently before the election was 47 million. I’ve since heard 40-50. I think the numbers are being massaged now so they appear lower.

If Obama were to get out of Afghanistan (Iraq is another story) there’s your health care plan basically covered. If America could “afford” Afghanistan, it could certainly afford health coverage for every American.

Winder November 11, 2009 8:03 am (Pacific time)

Very nice breakdown for us common folk, Ersun. Engle, very astute analysis. I agree with Amanda and Daniel. We need intelligent, thoughtful folks like these I mention here in our government, not the millionaire clowns who get elected just because they have money, thereby perpetuating and exacerbating the social divide between the "haves" and the "have-nots". Do not be discouraged, Ersun, by your small-minded detractors. You have a clear, rational grasp of the big picture---and you share it with us; your journalistic integrity is something scarce in the MSM.

Daniel Johnson November 10, 2009 6:05 pm (Pacific time)

Two significant threads here are that 1) the government shouldn't be involved in health care, and 2) that government handouts are somehow wrong. The alternative in both cases is to let the free market operate or prevail. Fine. But what happens when the FM not only fails, but is the source of much of the distress?

The unemployment rate is now over 10% and there are still 40-50 million Americans who have no health care. If the government is not to be involved, then this is clear case of free market failure or, at minimum, dysfunction.

The numbers are abstractions but on the ground you have people, just like you, being made homeless. Families, just like yours, going hungry. So, who’s responsibility is that?

These are people who are in dire straits through no fault of their own. Their only choice is to become self-reliant. But, if they have no option to become self-reliant; they can’t hunt or grow their own food when they live in cities, it’s only natural that they should turn to prey on their fellow citizens. As Samuel Johnson once wrote: “A decent provision for the poor is the true test of civilization.” America is about to reap what it has sown. Social breakdown on a national scale.

Scott November 10, 2009 2:38 pm (Pacific time)

Taxing the rich in the country, plus the businesses, still won't come close to paying the costs of this bill. It will come down to taxing everyone, somehow, even through "fines" and "fees".

Engle November 10, 2009 9:22 am (Pacific time)

Ersun the reason people can't buy health insurance as easily and cheaply as you can buy car insurance -- or a million other products and services available on the free market -- is that during World War II, FDR imposed wage and price controls. Employers couldn't bid for employees with higher wages, so they bid for them by adding health insurance to the overall compensation package. Although employees were paying for their own health insurance in lower wages and salaries, their health insurance premiums never passed through their bank accounts, so it seemed like employer-provided health insurance was free. Employers were writing off their employee insurance plans as a business expense, but when the IRS caught on to what employers were doing, they tried to tax employer-provided health insurance as wages. But, by then, workers liked their "free" health insurance, voters rebelled, and the IRS backed down. So now, employer-provided health insurance is subsidized not only by the employees themselves through lower wages and salaries, but also by all taxpayers who have to make up the difference for this massive tax deduction. How many people are stuck in jobs they hate and aren't good at, rather than going out and doing something useful, because they need the health insurance from their employers? Almost everything wrong with our health care system comes from government interference with the free market. If the health care system is broken, then fix it. Don't try to invent a new one premised on all the bad ideas that are causing problems in the first place. Everything above is further compounded by a huge unemployment rate causing a growing decline in tax revenue. We need job growth in the private sector, not the government sector. Currently no legislative policies are being implemented (nor any on the horizon) to stimulate private job growth. People are becoming more and more dependent on government programs, well who is paying for the different government programs and entitlements?

Scott in Reno November 9, 2009 2:32 pm (Pacific time)

Ersun, Thank you for pointing out the quick facts. It help me to find the sections I wanted to read and not get discouraged by the first several hundred pages of legalize that would put a insomniac immediately to sleep. I think too many people are either too trusting in Congress to do the right thing or they get turned away from the long legal documents that make up these important bills.

Ersun Warncke November 9, 2009 12:25 pm (Pacific time)

Somebody sent me an email asking when the taxes would become effective, which I forgot to include: Tax years beginning December 31, 2012

Caroline Lewis November 9, 2009 5:44 am (Pacific time)

Thank you for taking the time to summarize the first part of this legislation, and for being up front about the fact that it was nothing more than a plain reading of the actual text of the legislation. If more journalists would report the ACTUAL substance of the legislation, rather than regurgitating talking points of their political ideological compasses, perhaps the public could have an informed debate and remain civil about it. Wouldn't that be lovely? Anyway, great job. And Shawn? I would bet you money that a court would find this legislation to be Constitutional. Lots of money.

Ersun Warncke November 9, 2009 10:29 am (Pacific time)

Dennis Kucinich on why he voted NO on 3962: "We have been led to believe that we must make our health care choices only within the current structure of a predatory, for-profit insurance system which makes money not providing health care. We cannot fault the insurance companies for being what they are. But we can fault legislation in which the government incentivizes the perpetuation, indeed the strengthening, of the for-profit health insurance industry, the very source of the problem. instead of working toward the elimination of for-profit insurance, H.R. 3962 would put the government in the role of accelerating the privatization of health care. In H.R. 3962, the government is requiring at least 21 million Americans to buy private health insurance from the very industry that causes costs to be so high, which will result in at least $70 billion in new annual revenue, much of which is coming from taxpayers. This inevitably will lead to even more costs, more subsidies, and higher profits for insurance companies - a bailout under a blue cross.

Solitaire November 9, 2009 8:22 am (Pacific time)

I think this is awesome. I read the first bill release HR 3200 and I think that you have done the responsible thing here and posted the real facts. Even if no one else appreciates this, I do. So thanks for being a RESPONSIBLE journalist.

Keith Stirk November 9, 2009 7:56 am (Pacific time)

Amanda - Where in the Constitution does it say the government must supply health care? It does not and that is why this bill is UNCONSTITUTIONAL. All this does is enable people who want nothing but government hand outs. This is pure Socialism and the one problem with Socialism is you eventually run out of other peoples money.

Amanda November 8, 2009 10:23 pm (Pacific time)

It is "Unconstitutional" as well as "MORALLY WRONG" for millionms of citizens to be deprived of governemnt health insurance. The majority of citizen contribute to the economic growth of this country. (Not the big corporations!!!)

Shawn November 8, 2009 10:06 pm (Pacific time)

There is one thing you forgot...maybe it just slipped your mind...THIS WHOLE THING IS UNCONSTITUTIONAL! The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people. Argument completed!

Daniel Johnson November 8, 2009 6:06 pm (Pacific time)

Bravo! Ersun. Reading 360 pages has made you an informed correspondent on this issue. I think you're in a real minority among journalists on this. You've encouraged people to contact their own elected representatives (who almost surely would not have read the whole bill, let alone even 360 pages). People have to get involved with their government (which includes here in Canada as well). Governments have been too long co-opted by the rich, powerful and self-interested.

[Return to Top]©2025 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.