Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Nov-04-2010 11:19

TweetFollow @OregonNews

TweetFollow @OregonNews

Oregon Cultural Trust Releases Fiscal Year 2010 Report

Salem-News.com

|

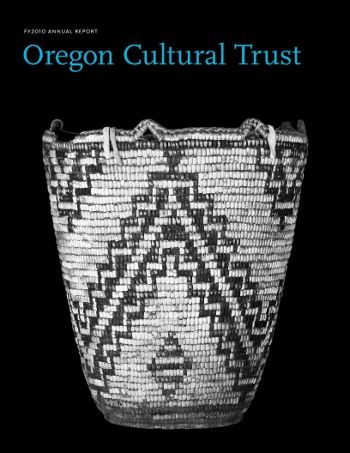

(SALEM, Oregon) - The Oregon Cultural Trust announces the publication of its Fiscal Year 2010 annual report. The report details the Trust's finances, programs and donors. It includes profiles of funded projects at Fishtrap, Oregon Caves Chateau and Portland Opera. The Trust's annual reports, from FY2003, are available at www.culturaltrust.org or by request from cultural.trust@state.or.us or 503-986-0088.

In FY2010, the Trust distributed $1.45 million in 92 grants to cultural nonprofits, county and tribal coalitions and statewide cultural agencies, based on FY2009 income of $4.1 million. In FY2010, the Trust increased its income from donations, cultural license plate sales and interest earned on its permanent fund to $4.2 million. Over 11,000 donors contributed to the Trust, taking advantage of Oregon's generous, unique and powerful cultural tax credit.

The Oregon Cultural Trust is the only cultural funding program of its kind in the nation. It's been ranked with the bottle and beach bills and vote-by-mail as among Oregon's most forward-thinking public policy measures and contributes to Oregon's reputation as a thought-leader, nationally. No other state rewards cultural donors with a 100% tax credit, which, essentially earmarks up to $500 for individuals; $1,000 for couples filing jointly; or $2,500 for corporations of a donor's taxes for cultural funding. Few state cultural agencies have a reach as broad as the Trust's, extending to heritage, humanities and arts.

No other state has an integrated cultural funding plan that supports statewide arts, heritage and humanities interests. The Trust's network of cultural coalitions, which distributes Trust funds to every county and federally-recognized tribe, allows Trust grantmaking to be deep as well as broad and provides state cultural funding to rural areas that, otherwise, would not have it.

Norm Smith, Trust board chairman, remarked, "Oregonians like to make their own decisions. The Cultural Trust program gives them a choice on how to spend their tax dollars. It's a powerful choice because the dollars donated to the Trust return to the very communities that define what it means to be Oregonian."

Chris D'Arcy, executive director of the Trust observed, "Giving to the Trust is a smart investment. Not only does it reward donors with a tax savings, it contributes to the future of cultural funding across Oregon. Fifty-eight cents of every dollar raised remains in the permanent endowment, while the remaining 42 cents returns to the community as grants."

Trust Manager Kimberly Howard added, "I'd like to remind Oregon taxpayers that donations must be postmarked by December 31, 2010 in order to claim a 2010 cultural tax credit. Or, you can give up to 11:59 PM on the 31st at www.culturaltrust.org -- by why wait? A donor envelope is included in every annual report."

The Oregon Cultural Trust is an innovative, statewide private-public program that raises money to support and protect Oregon's arts, humanities and heritage. In addition to building a long-term, protected endowment, the Trust distributes funds annually through three grant programs.

Donors to the Trust are eligible for a 100% Oregon income tax credit for contributions of up to $500 for individuals, $1,000 for couples filing jointly and $2,500 for corporations. To motivate Oregonians to increase direct giving to cultural groups, Trust donors must also make matching gifts to one or more of 1,300 cultural nonprofits in order to claim the tax credit. Since Oregon's cultural tax credit took effect in December 2002, 17,000 donors have contributed over $22 million to the Trust; more than $9 million has been distributed in grants statewide; and the endowment stands at $12 million. More information: 503-986-0088 or www.culturaltrust.org.

Source: Oregon Cultural Trust

Articles for November 3, 2010 | Articles for November 4, 2010 | Articles for November 5, 2010

Quick Links

DINING

Willamette UniversityGoudy Commons Cafe

Dine on the Queen

Willamette Queen Sternwheeler

MUST SEE SALEM

Oregon Capitol ToursCapitol History Gateway

Willamette River Ride

Willamette Queen Sternwheeler

Historic Home Tours:

Deepwood Museum

The Bush House

Gaiety Hollow Garden

AUCTIONS - APPRAISALS

Auction Masters & AppraisalsCONSTRUCTION SERVICES

Roofing and ContractingSheridan, Ore.

ONLINE SHOPPING

Special Occasion DressesAdvertise with Salem-News

Contact:AdSales@Salem-News.com

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

[Return to Top]

©2025 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.