Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

May-10-2017 23:00

TweetFollow @OregonNews

TweetFollow @OregonNews

America's Retirement and Health Issues in Sharp Focus

Salem-News.com BusinessOver 60% of retired people rely on Social Security for at least half their monthly income

Paycheck-to-paycheck Image: fellowshipofminds.files.wordpress.com |

(SALEM, Ore.) - Retirement in the USA has become a serious issue. There is a Social Security System in place yet its ongoing funding is in question. It was never designed to provide more than support to pensioners yet too few seem to have addressed the problems they are likely to face. A recent study by Fidelity looked at what is happening in society.

Fidelity Study Identifies Social Security Considerations

It is clear that many Americans have failed to grasp the potential problems of retirement. Too few have significant savings and the recent study suggests that 30% will take benefits from Social Security at their earliest opportunity, 62 years of age when the equivalent number a decade ago was 50%.Those who draw benefits early rather than wait until full retirement age, varying between 66 and 67, receive significantly less than they would by waiting, and perhaps as little as half they would get by delaying until 70.

If you think of 66 as 100%, then you will receive around 67% if you retire at 62, while if you wait until you are 70, you will receive 133%, effectively double.

If you assume that you receive $10,000 per annum at 62, you will have received $80,000 in total before you are 70 but the 70-year-old retiree will start at $20,000 and by the time you are both 78, the latter will have caught up in total receipts than exceed the early retiree by $10,000 per annum for life.

The calculation is therefore a personal one. Life expectancy is increasing but health is always an issue.

Fidelity’s study identifies that many people fail to grasp the detail of the System so have no idea whether their decisions are prudent or not.

Only a minority of citizens, 26%, actually knew the age applicable to them personally. Whatever age applies, people need to give three-months’ notice in order to start receiving benefits when they want them.

The most recent Social Security Administration (SSA) statistics reveal that over 60% of retired people rely on the Social Security System for at least half of their monthly income after retirement.

Perilous State of Family Finances

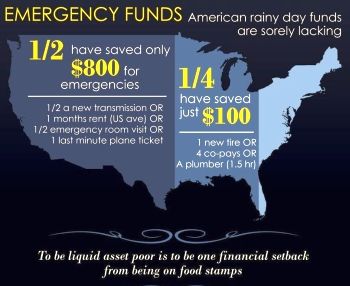

The issue of many Americans living from paycheck-to-paycheck needs to be addressed. The number of people with only minimal savings is quite disturbing.Figures suggest that a sizable minority of people have less than $25,000 set aside in a retirement plan.

Those already at middle age and beyond are simply not prepared for retirement and will have to rely on the Social Security System.

If there is one piece of advice that everyone should embrace, it is to get a budget and live by it.

It is the only way for people to prepare properly for the future without having to rely solely on the Social Security System which cannot guarantee to even pay out existing benefits beyond the short term; the fund is dwindling and will continue to do so without an injection of money. That means taxation, which is not popular with Trump or his Party.

A budget involves writing down every piece of expenditure and totaling up the detail. In too many households that figure appears to be similar to monthly income with no real provision for saving. In some cases, families appear to be subsidizing their lifestyle by using a credit card and building up an expensive balance at the same time. The rate of interest charged on credit card balances is prohibitive but that is something that too few people seem to be grasping.

While there are no nasty letters coming from credit card companies as long as you comply with the terms and conditions which include playing a minimum figure each month, you may be storing up future problems by carrying such expensive debt.

You may have to make some economies and even some sacrifices but you should aim to pay off any balances even if it is by taking out a personal loant is a much cheaper "credit product" than a credit card.

Trump and "Obamacare"

Just a few days after that Fidelity Study was published, the issue of health came sharply into focus as the new President, Donald Trump, seemed to have passed the initial hurdle in getting his ideas passed.Health costs have been increasing at a rate far beyond the rate of inflation, and with the inevitable link between health and age, there are likely to be serious problems ahead.

Trump’s delight that the House of Representatives recently supported his plans to destroy "Obamacare" (the Affordable Care Act) is just the beginning of the story.

Obama’s legislation offers help right across society while Trump’s plans will exclude a significant number of the population.

The major issue in health is the soaring cost, well ahead of any rate of inflation you can imagine. Many critics of health policies forget that, and no legislator has been able to fully solve that problem and its impact which inevitably hits the poor and the elderly harder than any other section of the community.

At least "Obamacare" sought to cap the costs involved in insurance.

The Republicans traditionally want less Federal interference and Trump’s hatred of the healthcare legislation currently in place has been obvious.

The problem is that the Party’s control of both Houses of Congress could be under serious threat if the Senate approves the health plans which exclude a sizable number of people currently covered.

There is a wafer-thin Republican majority in the Senate with many Senators clearly concerned that the proposals are not good enough.

Some think they are too severe, others too soft. In addition, the impact of supporting the plans could result in several Republicans in both Houses finding themselves under pressure to retain their seats in the mid-term elections next year.

The implications to a Trump Presidency which is already seriously divisive might set the scene for real issues in the second half of his term.

Conclusion

Old age and health are inextricably linked. There are issues looming in American society which will bring both under even sharper focus. There are interesting times ahead in the USA.Source: Salem-News.com Special Features Dept.

Articles for May 10, 2017 | Articles for May 11, 2017

googlec507860f6901db00.html

Salem-News.com:

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

[Return to Top]

©2025 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.