Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

May-07-2014 16:57

TweetFollow @OregonNews

TweetFollow @OregonNews

Anyone for Ouija Board?

The Board Game

Bill Annett Salem-News.com

When the rank and file are jumping off the caboose, you'll see me climbing on the locomotive. - Joe Granville, The Kansas City Guru

en.wikipedia.org |

(DAYTONA BEACH) - When I was a kid, there were no computer games. In fact there were no computers. But there were games. One game, typical for its intellectual content, went like this: you had this piece of cardboard with four corner spaces and laddered spaces in between, a pair of dice and several little plastic disks. Check that – there was no plastic then, either. The little disks were made of wood. Each player had four wooden disks.

You threw the dice. If, for example, you rolled eight, you moved a little wooden disk eight spaces. You took turns. The first person to move his four little wooden disks all the way around the board over all the laddered spaces was declared the winner of the game. Seriously.

It was called Parcheesi. Nobody knows why.

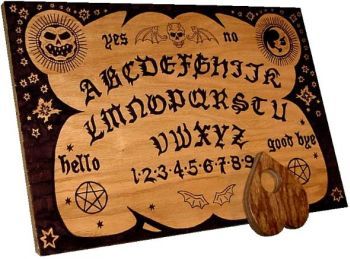

But when I was a kid, your most intellectual game was the Ouija Board. It consisted of a small wooden kidney-shaped chunk of wood on little stilts, which rested on a square board decorated with stars, crescents and other magical symbols, and also a variety of notations relating to topics such as your secret love, your character traits, your horoscopic probabilities and all manner of caveats and rewards.

The deal was, all the participants placed their fingertips on the wooden kidney-shaped thing, and it proceeded to move around the board all on its own. Unbelievable. Or so it seemed. It was believed by some that the wooden thing moved by some strange and unknowable force, some immortal hand or eye framing its fearful symmetry. Or were some of the fingers fudging?

The players took turns asking the kidney-shaped chunk of wood questions. Such as, “Will I meet my true love this year (or month, or week, or whatever)?” The Ouija thing would move and point to the word “yes,” or “no,” depending on what it believed in its little kidney-shaped wooden heart.

But some of the more worldly players believed that someone's fingers among the gathering had something to do with the movement, although with multiple fingertips in play, who could tell? The consensus was that the Ouija board had a mind of its own. Or was at least magically consensual, distilling the will of the assembled players. Like communal prayer working miracles. As a player, it helped if you had gone to Sunday School as a kid, or at least had a father in real estate.

The Dow Jones Industrial Index reminds me of a Ouija board. Everybody, financial media talking heads, Wall Street traders and Mom and Pop investors alike, collectively pretend that the market moves up, down or sideways in response to broad prevailing attitudes, producing a macroeconomic matrix taking into account the likely business cycle outlook, politics and the thousand internecine shocks that flesh is heir to. The Ouija-like stock market sorts all this matrix out and then acts with what is considered to be a mind of its own.

Doesn't that sort of give you a creepy feeling up your spine? On the other hand, sometimes I wonder if there are other twitchy fingers at work. Perhaps the market marches to a far more simplistic drummer – one which plays a powerful paradiddle, engaging huge volumes of automated, programmed institutional trading. This king-size institutional hanky-panky is leveraged even further by derivatives, derivatives based on still other derivatives (all of which consist of the placing of huge bets) creating an enormous volume of trading, largely for the benefit of proprietary in-house accounts within the investment banks ranged around The Street like gamesters hunched over a playing board.

My suggestion is that the fingers in the Wall Street hood - just maybe - take the Dow up and down like a freight elevator or, to unmix the metaphor, all over the board like an invisible Ouija presence, moving that kidney-shaped index to “yes” (up) or “no” (down) according to the avoirdupois of their position sheets, which is to say their inventory of bonds, stocks and short positions. Meanwhile, everybody pretends that the market has a mind of its own.

Meanwhile, like the mysterious Ouija board, the financial commentators attribute the market's movements to other systemic influences for the emolument of the credulous retail sector, and of course the gape-mouthed public. In a daily ritual, the talking heads unfailingly announce the unseen forces that are moving the market - arbitrary as they are logical, and (although never convincingly consistent) in an inexhaustible stream: corporate earnings reports or the lack thereof, any gastric disturbance within the Federal Reserve System (or indeed dyspepsia on the part of its grand vizier, the Chairperson), interest rates, money supply, the wealth of nations (or the lack thereof), and any suggestion or hint of egalitarianism in the halls of government, which might faintly suggest a soupcon of socialism, which is to say anathema to, and a perceived impediment to, unbridled greed.

For example, on a day in the recent past, two countervailing influences were announced as affecting the market. The good news was that corporate earnings reports were exceeding analysts' expectations. The bad news was that Spain was flat-ass broke. The market, faced with this mix, “plummeted” 200 points. Two days later, after a moderate profit-taking by the fingers on the day in between, the market “soared” 200 points on precisely the same two “influences.” The reasons, readily supplied by the soothsayers? Corporate earnings reports exceeded analysts' expectations and the pain in Spain was falling mainly on the sane.

So it simplifies my life if I plainly concede that the Dow is a Ouija board. Perhaps because “Ouija” means yes/yes in French/German. Yes, yes, as in seduction. As in someone getting screwed.

'Twas not always thus.

When I arrived on Wall Street 63 years ago, like Horatio Alger with my cardboard suitcase, my inappropriate B.A. and the lunch money Mummy had pinned inside my jumper, a million dollars was considered a fortune. Today it's the minimal annual gross of a junior bond salesman. My monthly compensation was about what a Monopoly player collects for passing “Go,” with the promise of two additional digits in my Christmas box, plus all the Republican comic books I could read. (Vote for Bob Taft.)

Today, my former monthly stipend is a reasonable tab for a client's lunch. Then, Warren Buffett had yet to read Ben Graham. Today, he's distinguished himself by defending Goldman Sachs' virtue (especially his $10 billion stake @ a prearranged 10%).

When Eisenhower had a heart attack in the Fifties, the market plummeted (no other journalistic tag will do) 20 points, in a world unhinged. Today it gives up twice that much if Maria Bartiroma calls in sick. The take of the average CEO in the good old days was 40 times that of the average drone in the trading department. (Such as me.) Today, the multiplier is more like 2,000-to-one.

A Ouija board may be fun for the guys with itchy fingers. But I long for the good old Monopoly board game, when you could get out of jail with the wave of a card and even trailer trash could walk on the Boardwalk. As for the Dow, it always looked like a picket fence going up hill, as it should have. A buyer for every seller, and a derivative was simply a chemical sea change or a calculus doodle.

Frankly, even in my youth, I thought the Ouija board was suspiciously fraudulent. I still do. But who can prove it? Certainly not the SEC.

A case in point: three years ago, the Fukushima disaster occurred in Japan, followed by the subsequent meltdown of common sense in the financial markets of the world

I was a youthful stock broker when Eisenhower suffered a heart attack. I was a money market trader when Jack Kennedy was assassinated. I was a recovering institutional rep and freelance columnist during the Crash of '87. More recently, when the world cried “What the Fukushima?” I was an octogenarian beachcomber. But I viewed the barnyard panic of the opportunistic Chicken Littles on Wall Street, in the Paris Bourse, Germany's DAX, the Hang Seng and London's usually sober City, who registered feigned dismay over the fate of the Emperor of Japan (and his daughter-in-law-elect) chanting that “the sky is falling.“

The pattern of those four financial catastrophes in 60 years was the same. The investing public ran for the exits, causing world markets to “plummet,” that favored expression of idiot journalists, who a few days later would report that those same markets had “soared.” The feverish heat was fanned by those professional traders, hedge fund managers and private equity johnnies around the world, those ancestral voices prophesying doom, while they themselves were shorting their butts off in the pre-market trade, in order to cover their manque positions at depressed levels a scant day or so later. (The ancient bankers' axiom: “We view with alarm in order later to point with pride.”)

In each case, the investing public (to use Peter Lynch's mot) like the fabled Emperor, lost not only their clothes but their collective shirts, while the pros comme toujours made millions.

Over Eisenhower's sickbed in the Fifties, nobody paused to consider that had Ike gone to Republican Heaven, he would have been replaced by an even more Street-oriented Nixon. Flash forwarding to 2011, the tragic fate of three thousand innocent Japanese people, the collapse of their energy infrastructure and a possible disastrous contamination of Japan and the North Pacific atmosphere all had, in narrow economic terms, little to do with the price of ethanol in Kansas, the Libor rate, transatlantic arbitrage – or Mom and Pop's annuity with the Hartford.

It mattered not to the unleashed dogs of the Dow.

Footnote: If the sky were really falling, gold should have “soared.” But suicidal investors were liquidating gold positions all through that long day, with the apparent assumption that paper money would be of some benefit if the end was indeed nigh.

I've quoted my old friend Joe Granville, the Kansas City seer above, on the mystique of men and markets. If Joe'd had time for games, I think he would have preferred Monopoly to the Ouija Board. But it's nice to know, in these uncertain times, that – like the Ouija board - our financial security is in good hands. At least with the fingers that know what they're doing.

Bill Annett grew up a writing brat; his father, Ross Annett, at a time when Scott Fitzgerald and P.G. Wodehouse were regular contributors, wrote the longest series of short stories in the Saturday Evening Post's history, with the sole exception of the unsinkable Tugboat Annie.

At 18, Bill's first short story was included in the anthology “Canadian Short Stories.” Alarmed, his father enrolled Bill in law school in Manitoba to ensure his going straight. For a time, it worked, although Bill did an arabesque into an English major, followed, logically, by corporation finance, investment banking and business administration at NYU and the Wharton School. He added G.I. education in the Army's CID at Fort Dix, New Jersey during the Korean altercation.

He also contributed to The American Banker and Venture in New York, INC. in Boston, the International Mining Journal in London, Hong Kong Business, Financial Times and Financial Post in Toronto.

Bill has written six books, including a page-turner on mutual funds, a send-up on the securities industry, three corporate histories and a novel, the latter no doubt inspired by his current occupation in Daytona Beach as a law-abiding beach comber.

You can write to Bill Annett at this address: bilko23@gmail.com

|

|

|

Articles for May 6, 2014 | Articles for May 7, 2014 | Articles for May 8, 2014

Quick Links

DINING

Willamette UniversityGoudy Commons Cafe

Dine on the Queen

Willamette Queen Sternwheeler

MUST SEE SALEM

Oregon Capitol ToursCapitol History Gateway

Willamette River Ride

Willamette Queen Sternwheeler

Historic Home Tours:

Deepwood Museum

The Bush House

Gaiety Hollow Garden

AUCTIONS - APPRAISALS

Auction Masters & AppraisalsCONSTRUCTION SERVICES

Roofing and ContractingSheridan, Ore.

ONLINE SHOPPING

Special Occasion DressesAdvertise with Salem-News

Contact:AdSales@Salem-News.com

googlec507860f6901db00.html

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

KickShot Soccer Board Game May 8, 2014 9:35 am (Pacific time)

Mr. Annett, Your article cleverly tied board games with the market.....a truly admirable and inspiring read. You have a wonderful understanding of history, financial market and board games. Furthermore, your article introduced me to Salem-News.com and its eclectic writings. Thank you. Since the article expresses your interest in board games, I invite you and your readers to visit www.kickshot.org to peruse a game I created to stimulate family time.

Marvinoi May 8, 2014 8:29 am (Pacific time)

Hello!

Administrators, please tell me how to add a video from youtube to a post?

Thanks!

They do not show up in the comment posts, you can always mail us the link at newsroom@salem-news.com and we can add it.

[Return to Top]©2025 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.