Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Jan-18-2007 19:12

TweetFollow @OregonNews

TweetFollow @OregonNews

DeFazio Votes to Cut Interest Rates on Student Loans

Salem-News.comWhen fully phased in, the bill would save typical student borrower in Oregon $4,740 over the life of their loans.

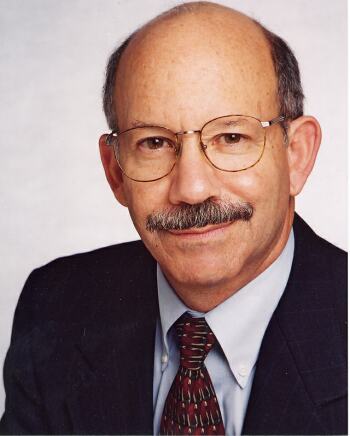

U.S. Congressman Peter Defazio |

(WASHINGTON, D.C.) - Almost a year after the Republican Congress passed legislation to raise interest rates on subsidized student loans in order to pay for tax cuts for the wealthy, U.S. Congressman Peter DeFazio (D-OR) voted to reverse that increase.

The House passed a bill that will make college more affordable and accessible by reducing the rate on subsidized college loans for undergraduates in half over the next five years—cutting the interest rate from the current 6.8 percent to 3.4 percent.

The House passed the bill Thursday by a vote of 356 to 71.

"In a cynical move last year, the Republican Congress voted to increase student loan rates in order to pay for more tax cuts for wealthy investors," DeFazio said.

"Today, Congress reversed that increase, cutting the interest rates of subsidized student loans in half. This legislation reflects the priorities of average Americans, not the wealthiest few. It targets low-and middle-income students and families with the most financial need—those who receive subsidized student loans. And it doesn't add a penny to the deficit.

"Tuition and fees at four-year public colleges and universities have risen 41 percent in six years. We must ensure that a good education is within the grasp of every American. Reducing interest rates on subsidized student loans is just a first step toward addressing this problem."

Later this year, Democrats will also increase the maximum Pell Grant scholarship and take other important steps to reduce the financial barriers to a college education.

The plan is paid for by making modest reductions in certain lender and guaranty agency subsidies in order to make the student loan program more efficient and effective for students and American taxpayers.

Once the plan is fully phased in, the average student borrower in Oregon would save $4,740 over the life of their loans.

In the 2004-2005 school year, there were 40,721 subsidized loan borrowers in Oregon at four-year institutions, including 13,831 at OSU and the University of Oregon

Articles for January 17, 2007 | Articles for January 18, 2007 | Articles for January 19, 2007

Quick Links

DINING

Willamette UniversityGoudy Commons Cafe

Dine on the Queen

Willamette Queen Sternwheeler

MUST SEE SALEM

Oregon Capitol ToursCapitol History Gateway

Willamette River Ride

Willamette Queen Sternwheeler

Historic Home Tours:

Deepwood Museum

The Bush House

Gaiety Hollow Garden

AUCTIONS - APPRAISALS

Auction Masters & AppraisalsCONSTRUCTION SERVICES

Roofing and ContractingSheridan, Ore.

ONLINE SHOPPING

Special Occasion DressesAdvertise with Salem-News

Contact:AdSales@Salem-News.com

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

dr. barley January 19, 2007 7:00 pm (Pacific time)

if Donna's bill goes thru., we'll have english speaking illegals for half the price! no need learn more but political science!, no need to borrow money in order to scrounge around in the grease.,get somebody else to do it! instead go right to the top echalon!.,Political Science! Corporate Law!! quite the ring of importance.,Doctorates available!,you may not learn to DO anything.,but you can run a whole country!

Albert Marnell January 19, 2007 6:31 pm (Pacific time)

Who cares about the interest rate when the default rate on the principal is so high? Go to trade school. We need more good carpenters, electricians, plumbers, roofers, painters, bakers, hotel personnel, nurses, morticians etc. etc.

[Return to Top]©2025 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.