Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Jan-16-2008 06:10

TweetFollow @OregonNews

TweetFollow @OregonNews

Study: Black Americans Should Get Reparations for Housing Discrimination

Salem-News.comThe researchers said the majority of young, first-time white homebuyers today receive money from their parents to help them afford a home.

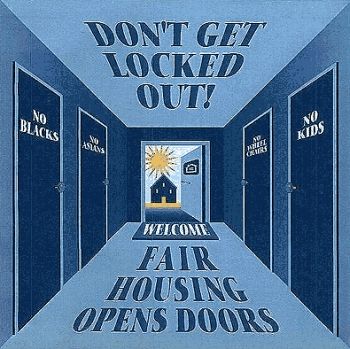

Image courtesy: fhosc.org |

(CORVALLIS, Ore. ) - Historic housing and lending discrimination against black Americans has created a significant discrepancy in their overall wealth – a gap that may take reparations to close, according to research published by two Oregon State University faculty members.

Jonathan Kaplan, associate professor and chair of the Department of Philosophy, and Andrew Valls, assistant professor in the Department of Political Science, published their study in the July issue of Public Affairs Quarterly. In the study, they argue for a shift from viewing reparations in the framework of slavery to emphasizing relatively recent housing discrimination practices which continue to put people of color at a disadvantage.

The average black American has only about 15 percent as much wealth as the average white American, even though black Americans earn about 60 percent as much as white Americans. And at every income level, white Americans have much more wealth than black.

Wealth is a measure of a person’s total net worth – essentially, their assets minus their debts. For people in the middle-class, homes tend to be by far the biggest asset. And a large fraction of the black/white “wealth gap” is related to the very different home ownership rates of white and black Americans, and the differences in the value of homes owned by black and white Americans.

Kaplan and Valls argue that this situation was created by government programs that deliberately made it much more difficult for black Americans to acquire homes at the same time they made it much easier for white Americans to acquire homes.

Before the creation of the temporary Home Owner’s Loan Corporation (HOLC) in 1933, and its permanent successor, the Federal Housing Authority (FHA) in 1934, relatively few Americans owned their homes.

The FHA made home ownership possible for many Americans by introducing low down-payment, long-term fixed-interest, self-amortizing loans. In 1938, the creation of the Federal National Mortgage Association (“Fannie Mae”) provided a market for Federal Housing Authority (FHA) loans, increasing liquidity and further decreasing lender risk.

As Kaplan explains, black Americans were almost completely excluded from benefiting from these loans because the FHA assigned “risk” rating to neighborhoods, based on various demographic factors, especially race. Mixed and predominantly black neighborhoods were rated as “riskier” and were generally not eligible for FHA loans.

Valls said after World War II, the G.I. Bill led to a housing boom where returning soldiers bought new homes in the newly-formed suburbs. However, black veterans were largely excluded from the housing benefits of the G.I. Bill.

“The FHA manual at the time stated that ‘If a neighborhood is to retain stability, it is necessary that properties shall continue to be occupied by the same social and racial classes,’” Valls said. “So for a home to be insurable, a neighborhood had to be white and to stay white.”

To ensure that stability, the FHA actively promoted the use of racial covenants – legal restrictions on who houses could be sold to – in order to protect against transitions to mixed neighborhoods. According to Kaplan and Valls, by some estimates 80 percent of new suburban housing developments in the 1930s and ’40s included such covenants.

“So even if you wanted to sell your home to a person of color, you couldn’t,” noted Valls. Valls said he recently found a racial covenant in the original deed for his 1949 home that stated that the home was “not to be sold to blacks or Asians.”

In 1948, the Supreme Court ruled these covenants to be unconstitutional. However, Kaplan and Valls said that discriminatory practices continued well into the 1980s.

“This was a very explicit widespread discrimination that had real impact on people’s well-being and their ability to have that cushion that comes from having assets such as a home,” Valls said.

Kaplan added: “Access to equity in a home gives you a back-up in case of an emergency; it gives you something to fall back on. Historically, it helps you build on what you have: to hold out for a better job, upgrade to a better neighborhood, get other loans. If you are denied the opportunity of home ownership, it affects your entire way of life.”

Valls and Kaplan said the majority of young, first-time white homebuyers today receive money from their parents to help them afford a home. This is not the case for black first-time homebuyers, however, because of the lack of ownership history.

The researchers believe that reparations for this government-supported discrimination are necessary. Using a model where they compared the current average wealth of white Americans due to home equity to the current average wealth of black Americans due to home equity, they believe that reparations in the billions – and perhaps hundreds of billions – may be owed to black Americans.

In their paper, they advocate for programs that would help correct some of these recent historical injustices.

They believe that low-interest federal government home and business loans aimed at (but not exclusive to) black Americans would help remedy a system that has discriminated against blacks since the 1930s and caused a historic gap in wealth between black and white Americans.

“Black Americans ought to be eligible for very favorable terms on mortgages, with very low interest rates and low or no down payment, with both mortgage insurance and the low interest rates subsidized by the government,” Kaplan said.

In addition, they said that blacks should be provided with opportunities that would lead to the creation of wealth through means beyond the housing market alone:

• Improved access to good primary education;

• Improved access to funding for secondary education;

• Very favorable terms for loans to start new businesses, etc.

• Improved “safety nets” for crises.

“Some of these policies that might contribute to closing that wealth gap would benefit people of all colors,” Valls said. “But the important part is that it closes that gap.”

Articles for January 15, 2008 | Articles for January 16, 2008 | Articles for January 17, 2008

Salem-News.com:

googlec507860f6901db00.html

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

sweet h. dhana March 3, 2009 6:00 am (Pacific time)

tnx for sharing the knowledge

Vidal D. Driver March 17, 2008 4:15 pm (Pacific time)

One proposal my wife suggested for reparations for African Americans, is a federal government funded program that will assist African American families with understanding who they are; and where they came from. A family tree. The PBS show, African American Lives is a prime example. A select group of people (famous African Americans) family tree was developed and DNA was extracted to conclude what part of Africa their family may have come from. Vidal D. Driver (678)617-4497 DETERMINE06@HOTMAIL.COM

Jefferson January 18, 2008 9:16 am (Pacific time)

I think this is a great idea! I have always felt that the $trillions$ we have spent simply has not been enough. I believe that it would also be prudent to provide more of our treasury to help ameliorate the suffering that no doubt has it's roots in Post Traumatic Slave Syndrome. Maybe down the line the author's of this study would like to address black crime, maybe even the black on Caucasian/Hispanic/Asian/Native American rate? Actually it would be my hope that if they would do that, which would be quite unlikely, that they use the primary source, i.e. , the U.S. Justice Department. The crime rates are astounding people, and the socio-economic perspective re:causal variables for these incredibly huge black crime rates, simply are not a significant factor when one compares other races using the same criteria. So what could the reasons for this high barbaric crime rate be? Maybe Barak Obama's Chicago church leader could provide one perspective? Maybe his buddy Farakhan could also? Since some people/organizations are opining for more tax money, then lets look at the big picture! My position is that the "real" racist hater's out there do not want that, many are from the same pathetic ilk that suppress other types of information also... (last part removed) Editor: There was a lot of discussion here last night about insulting posts and I understand that some people may have missed it. If anyone's intent is to just stir the pot meaninglessly then they are going to be removed from the mix. This is going to become a more intelligent forum where people are not too intimidated to visit here and leave a comment. I hope I am being clear, thanks.

Vic January 18, 2008 7:35 am (Pacific time)

Other groups that studies have proven are discriminated against are: redheads, gays, short people,unattractive women, stutterers,the obese, and at one time, people with tattoos.I got a lot of flak in the early 70s because I had long hair. I wonder if I have any cash coming? We are going to need a lot of money....

Tod Andreson January 18, 2008 6:10 am (Pacific time)

I think it is wrong, no, unwise to say just off of philosophical reasoning that some proposed social resolution can or can not work. I am neither for or against reparations for African Americans. There is no question that Blacks have been victims to some of the cruelest and inhumane treatment to man history has ever known. Doesn't take a genius to figure that out. Reparations will not heal history's wounds. As a White American, I even find it offensive when other Whites say, "well we gave you welfare and affirmative action." As if to say forty years of a handout is just payment for four hundred years of indentured service, slavery, rape, murder and social and economic discrimination. And stop this nonsense of throwing Oprah's name out as a prototypical beacon of success. That's like me measuring every White American based on the success of Bill Gates, comparatively speaking.

Neal Feldman January 16, 2008 5:49 pm (Pacific time)

Jonathan Kaplan - Nowhere did I say unfairness does not exist. I merely asked relevant questions. It is easy to say "Oh, hey gang! Let's give reparations for past unfairness!" As my questions tried to highlight it is far more difficult to actually do it and do it in a way that makes sense, is not in and of itself inherently just as unfair as that which it seeks to address, etc. So, can you cite in the text of the paper exactly where all my questions are completely accommodated? Didn't think so. Seems there is much more work on the project to be done before there is any attempt at actual implementation. Ah well...

Jonathan Kaplan January 16, 2008 4:18 pm (Pacific time)

Neal, It might be worth your time to take a look at the paper itself -- you can find it at: http://oregonstate.edu/cla/philosophy/ The basic issue, as Andrew and I see it, is that policies put in place by government agencies permitted white Americans to gain wealth through home equity, very much at the expense of black Americans. Yes, officially sanctioned discrimination ended some time ago, but the harms done by that discrimination are passed down through generations. The market is a very poor method for addressing these inequalities -- because of the way that wealth is passed down between generations, even if there really were *no* more discrimination in housing, etc., it would still take an unfairly long time (hundreds of years) for the effects of the inequalities produced by FHA policies and government inaction to be undone. White Americans did not "deserve" in any strong sense the government subsidized programs that permitted them to buy houses -- and still make owning a house an equity building enterprise. No one "deserved" in any strong sense having the government insure mortgages, create markets for mortgages, and loosen the rules on lending. This isn't to say that doing so was wrong -- in many ways, the "home ownership" experiment the U.S. launched in the late 1930s has been remarkably successful (for white Americans, anyway). But those subsidies were, and remain, a kind of welfare for homeowners. And since black American's were excluded from these programs, they suffered unfairly. Because black Americans were shut out of wealth-building home-ownership, and because government policies created a situation in which the neighborhoods blacks lived in were systematically denied important resources, we suggest that addressing the current inequalities in wealth via government funded policies is necessary.

James January 16, 2008 1:30 pm (Pacific time)

I never thought I would hear myself say this, but, Well said Mr. Feldman.

Neal Feldman January 16, 2008 11:50 am (Pacific time)

The questions really are : 1) It has been 6 decades (3-4 generations) since the ruling... and even if you go into the 80s it is a generation or two. So how much of the current situation blacks, or anyone for that matter, find themselves in is their own doing that none of the issues in the article are relevant to? In such cases why should any reparations be owed? 2) It is clear that in the US blacks can prosper. Oprah Winfrey is one of the richest and most influential people in the country and she is not only black but also a woman which might have been considered an additional barrier to her success. Should Oprah get these special rights/special treatments too? If not how do you draw lines? 3) Many white folks have never in their family history owned real estate either. Why should they be excluded from these special rights/special treatments? Isn't the policy being proposed as racist as what it was supposed to correct for? 4) Who ends up paying for this largesse? Lenders? I don't think so. They will just pass the costs on to others (read: whites). Why should Joe low white guy who never harmed a black person or held them back in his entire life pay for the sins of others? 5) Wouldn't this create a two-tier real estate market that would drive up costs for those unable to get in on these special rights/special treatments programs, probably to the point of denying home ownership to those who currently could manage it but under the new paradigm would be unable to? Wouldn't this just be creating a reverse situation that in 60 yrs would have whites screaming for reparations? Have to keep these questions (and others) in mind on the topic. Ah well...

Henry Ruark January 16, 2008 11:03 am (Pacific time)

Never forget, either that this President paid with his life for his realistic actions guided by his wisdom. That's been neocon reaction to defiance, delay and sometimes defeat for a very long time, even before the current perverted crop of same-values distortionists came into being, from a very frustrated two-party cabal discarded by both sides of the aisle.

NavyVet January 16, 2008 9:02 am (Pacific time)

On Monday we celebrated United States Navy General Order #4, or what is known as the Emancipation Proclamation. President Lincoln was a very wise man. If you look at the raw data which is on VA.gov you will find that the Federal GI Bill for home loans is almost non-existent in this state. The mortgage industry will do anything it can to take the focus off of itself. An industry that belongs where it is headed, in the garbage can.

[Return to Top]©2025 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.