Publisher:

Bonnie King

CONTACT:

Newsroom@Salem-news.com

Advertising:

Adsales@Salem-news.com

~Truth~

~Justice~

~Peace~

TJP

Feb-19-2009 07:26

TweetFollow @OregonNews

TweetFollow @OregonNews

Residential Property Values Fell $2.4 Trillion During 2008 According to Newly Released Data

Salem-News.comSalem home prices decrease.

Salem-News.com |

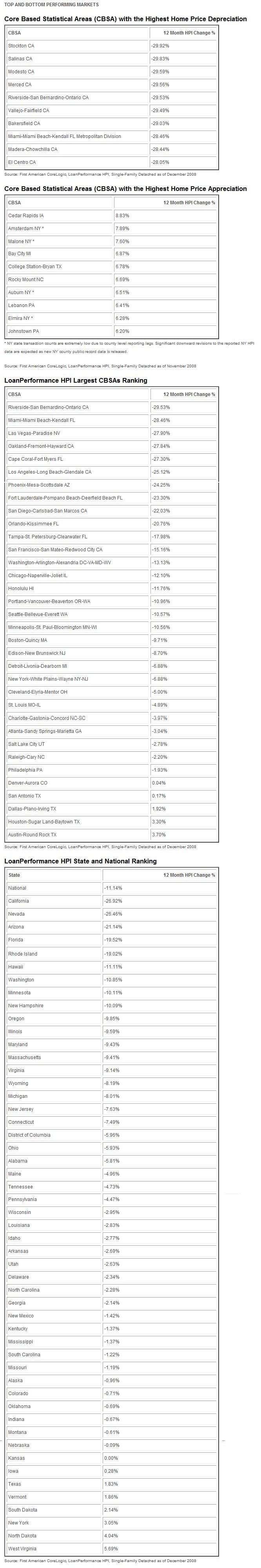

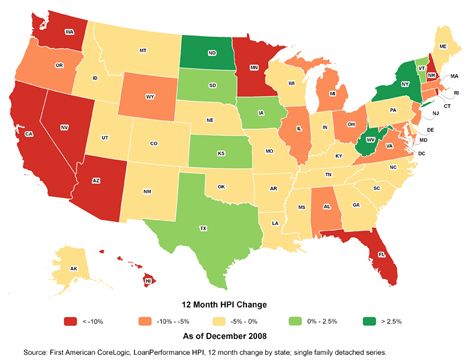

(SALEM, Ore.) - Home prices across the country declined 11.1 percent in December 2008 compared to a year ago, and the total value of residential properties for December 2008 was $19.1 trillion, down $2.4 trillion from $21.5 trillion in December of 2007, according to First American CoreLogic and its LoanPerformance Home Price Index (HPI).

In Salem, home prices have decreased 8.98 percent in December compared to a year ago.

Since July 2006 when U.S. home prices peaked, home prices have declined 19.3% on a cumulative basis and are currently back to the lowest price level since May 2004. The December decline represents 12 straight months of depreciation on a national basis.

The number of metropolitan markets experiencing price declines is, by far, the highest ever. As of December 2008, over 700, or nearly three-quarters, of all metropolitan markets were experiencing home price depreciation, up from 254 markets experiencing depreciation in December 2007 and 394 in June 2008.

California continued to lead the way, declining 26.9 percent from a year ago, with Nevada a close second at 26.5%. They are followed by Arizona (-21.1%), Florida (-19.5%), and Rhode Island (-19.0%). The largest acceleration in home price declines during the fourth quarter of 2008 occurred in Maine, Pennsylvania, Arkansas, Oregon and Rhode Island.

The supply of housing inventory remains very high relative to sales, and given the rapidly deteriorating economy, prices are expected to decline in 2009 and 2010, but at a more moderate pace.

"During 2008 homeowners lost a total of $2.4 trillion of their housing wealth, which will continue to put significant stress on consumer balance sheets, particularly as job losses continue to grow. The geographic breadth of price declines rapidly expanded in the second half of 2008, which means that housing wealth losses are broadening across much of the country" said Mark Fleming, Chief Economist for First American CoreLogic.

Methodology:

The LoanPerformance HPI incorporates more than 30 years worth of repeat sales transactions, representing more than 45 million observations sourced from First American CoreLogic's industry-leading property information database. LoanPerformance HPI provides a multi-tier market evaluation based on price, time between sales, property type and loan type (conforming vs. nonconforming).

The LoanPerformance HPI is a repeat-sales index that tracks increases and decreases in sales prices for the same homes over time, which provides a more accurate "constant-quality" view of pricing trends than basing analysis on all home sales. The LoanPerformance HPI provides the most comprehensive set of monthly home price indices and median sales prices available covering 7,618 ZIP codes, 958 Core Based Statistical Areas (CBSA) and 677 counties located in all 50 states and the District of Columbia. Full-month October and through mid-month November 2008 state and top CBSA-level data can be found at loanperformance.com/products/hpi.aspx.

Articles for February 18, 2009 | Articles for February 19, 2009 | Articles for February 20, 2009

googlec507860f6901db00.html

Salem-News.com:

Terms of Service | Privacy Policy

All comments and messages are approved by people and self promotional links or unacceptable comments are denied.

ChrisJones February 19, 2009 10:56 pm (Pacific time)

These houses were never worth that much to begin with, it was merely an illusion performed by the federal reserve.

[Return to Top]©2025 Salem-News.com. All opinions expressed in this article are those of the author and do not necessarily reflect those of Salem-News.com.